Iran's Deepening Economic Crisis: Sanctions, Scarcity, And Unrest

The Unprecedented Depth of Iran's Economic Crisis

As of December 2024, Iran finds itself mired in what analysts universally describe as its deepest and longest economic crisis in modern history. The nation’s economy, already fragile from decades of complex internal and external pressures, is now spiraling into an unprecedented downturn. This isn't merely a cyclical recession but a structural collapse exacerbated by a perfect storm of factors. The sheer scale of the contraction and the widespread impact on everyday life distinguish this period from previous economic downturns. Businesses struggle to survive, unemployment figures soar, and the purchasing power of the average Iranian citizen diminishes with alarming speed. The very fabric of Iranian society is being tested as families grapple with the escalating costs of basic necessities and the uncertainty of their financial future. This pervasive sense of instability underscores the severity of the economic crisis in Iran, painting a grim picture for the foreseeable future. The nation's ability to provide essential services, maintain infrastructure, and foster economic growth has been severely compromised, leading to a palpable sense of stagnation and decline across various sectors.Sanctions as the Primary Economic Chokehold

At the heart of the current economic crisis in Iran lies the relentless pressure of international sanctions, particularly those reimposed with renewed vigor under former United States President Donald Trump. These comprehensive sanctions are designed to isolate Iran from the global financial system and cripple its primary source of revenue: oil exports. By targeting key sectors of the Iranian economy, these measures have severely limited the country's access to international markets, making it incredibly difficult for Iran to conduct normal trade, attract foreign investment, or even process payments for legitimate transactions. The effects are far-reaching, impacting not just the government's coffers but also the private sector, which struggles to import essential goods, raw materials, and technologies. The sanctions regime acts as a financial blockade, preventing Iran from leveraging its natural resources and human capital effectively on the world stage, thereby deepening its economic woes and contributing significantly to the ongoing crisis.The Crippling Blow to Oil Exports

Iran, a nation blessed with vast hydrocarbon reserves, has historically relied heavily on oil exports as the lifeblood of its economy. However, the reimposition of sanctions, particularly those targeting its energy sector, has delivered a crippling blow to this vital revenue stream. These sanctions have effectively cut off Iran from its traditional oil markets, forcing a drastic reduction in its export volumes. While exact figures are often obscured due to clandestine operations, it is widely understood that Iran's oil sales have plummeted to a fraction of their pre-sanction levels. This dramatic reduction in oil revenue has starved the government of much-needed foreign currency, essential for funding public services, importing goods, and maintaining economic stability. The inability to sell its primary commodity freely on the international market is perhaps the single most significant factor contributing to the severity of the current economic crisis in Iran, leaving a gaping hole in the national budget and exacerbating inflation.Isolation from Global Markets

Beyond oil, the international sanctions have had a broader, equally devastating effect: isolating Iran from the global market. This isolation extends to banking, finance, shipping, and even the procurement of humanitarian goods. Iranian banks are largely cut off from the SWIFT international payment system, making cross-border transactions incredibly complex and often impossible. This financial exclusion not only hampers legitimate trade but also deters foreign investors who fear secondary sanctions. Businesses struggle to find partners willing to risk engaging with Iran, leading to shortages of imported goods, spare parts, and technology across various industries. The inability to participate fully in the global economy stifles innovation, limits competition, and prevents Iranian businesses from accessing the capital and expertise needed for growth. This profound isolation further entrenches the economic crisis in Iran, transforming it from a mere downturn into a systemic challenge that affects every facet of economic life.A Legacy of Mismanagement and Oil Dependency

While international sanctions are undeniably a major catalyst, Iran's economic woes are also deeply rooted in a legacy of internal mismanagement and an over-reliance on oil. For decades, the Iranian economy has been characterized by a lack of diversification, with the oil sector dominating national income and export revenues. This dependency makes the country highly vulnerable to fluctuations in global oil prices and, more critically, to external pressures like sanctions that target its energy sector. Furthermore, successive governments have been criticized for economic mismanagement, including inefficient state-owned enterprises, a complex and often corrupt bureaucracy, and a lack of transparency in financial dealings. Subsidies, particularly on energy, have distorted market prices, encouraged wasteful consumption, and drained government resources that could otherwise be invested in productive sectors. These structural weaknesses, combined with a reluctance to implement meaningful economic reforms, have created an inherently fragile economy. Thus, when the hammer of sanctions fell, these pre-existing conditions ensured that the impact would be amplified, pushing the nation deeper into the current economic crisis in Iran.The Looming Threat of Hyperinflation and Unrest

The most immediate and terrifying consequence of Iran's spiraling economic crisis is the looming threat of hyperinflation, which carries the potential to ignite widespread social unrest. According to a joint Israeli and Western intelligence assessment cited by Bloomberg, if regional conflicts continue to escalate, inflation in Iran could skyrocket to 80% or higher. Such a rate would devastate the purchasing power of ordinary citizens, making basic necessities unaffordable for a significant portion of the population. The specter of hyperinflation is not just an economic indicator; it's a direct threat to social stability, as historical precedents show that rampant price increases often precede widespread public discontent and protests. The government's inability to control inflation directly impacts the daily lives of millions, creating a volatile environment where economic grievances can quickly translate into political challenges.Inflation's Grip: A Daily Struggle for Iranians

For the average Iranian family, inflation is not an abstract economic concept but a daily, grueling struggle for survival. Prices for food, housing, medicine, and transportation are soaring, often changing by the hour in some markets. Wages, for those fortunate enough to be employed, simply cannot keep pace with the escalating cost of living. This disparity forces families to make impossible choices, cutting back on essentials, pulling children out of school, or taking on multiple jobs just to put food on the table. Savings are rapidly eroded, and the future becomes increasingly uncertain. The constant erosion of purchasing power creates a pervasive sense of anxiety and despair, as the dream of a stable life slips further out of reach. This relentless pressure on household budgets is a tangible manifestation of the severe economic crisis in Iran, leaving countless citizens in a state of perpetual financial distress.The Specter of Social Unrest

The historical link between severe economic hardship and social unrest is well-documented, and Iran is no exception. Past waves of protests in the country have often been triggered or exacerbated by economic grievances, such as fuel price hikes or rising inflation. If the predicted hyperinflation of 80% or more materializes, it could very well spark widespread unrest on an unprecedented scale. A population pushed to its economic limits, struggling to feed their families and facing a bleak future, is more likely to take to the streets to voice their frustrations. The government's fear of such an outcome is palpable, influencing its policy decisions and its reluctance to implement necessary but potentially unpopular reforms. The economic crisis in Iran, therefore, is not just a financial problem but a significant challenge to the regime's legitimacy and control, with the potential for widespread civil disobedience looming large.Paradox of Plenty: Iran's Energy Crisis

Adding another layer of complexity to Iran’s economic troubles is an ongoing energy crisis, a situation that presents a profound paradox. Despite being one of the world’s largest oil and natural gas producers, the country faces frequent power shortages, fuel rationing, and disruptions in energy supply. This is a perplexing reality for a nation sitting on immense hydrocarbon reserves. The reasons are multifaceted: years of underinvestment in infrastructure, inefficient energy consumption due to heavily subsidized prices, and the difficulty of importing necessary equipment and expertise due to sanctions. Aging power plants, a dilapidated electricity grid, and a lack of capacity to refine enough fuel for domestic consumption all contribute to this bizarre scenario where an energy superpower struggles to meet its own internal energy demands. This internal energy crisis not only impacts daily life but also stifles industrial production and economic activity, further exacerbating the broader economic crisis in Iran.The Regime's Reluctance to Reform

Faced with this deepening crisis, Tehran has shown a marked reluctance to embark on significant economic reforms, particularly those that involve cutting energy subsidies. This hesitation stems from a deep-seated fear that such measures, while economically rational in the long term, could immediately fuel inflation and trigger fresh unrest. Energy subsidies, which keep the prices of gasoline, electricity, and natural gas artificially low, are a massive drain on the national budget. However, they are also a crucial social safety net, providing a form of indirect welfare to the population. Removing or significantly reducing these subsidies would inevitably lead to a sharp increase in the cost of living, directly impacting ordinary citizens already struggling with inflation. The clerical regime, acutely aware of the potential for public backlash and widespread protests, finds itself in a difficult bind: implement necessary but unpopular reforms and risk social upheaval, or maintain the status quo and watch the economy continue its downward spiral. This strategic paralysis, driven by political expediency, further entrenches the economic crisis in Iran, preventing the structural adjustments needed for long-term recovery.Geopolitical Priorities Amidst Domestic Hardship

Perhaps one of the most controversial aspects of Iran's current situation is the clerical regime's continued financial support for its proxy forces in the Middle East, even as its own population endures severe economic hardship. Reports suggest that despite the profound financial crisis at home, the regime continues to funnel resources, often described as "suitcases full of cash," to groups like Hezbollah in Lebanon, various militias in Iraq and Syria, and the Houthis in Yemen. This allocation of scarce resources to external geopolitical objectives, while Iranian citizens grapple with rampant inflation, unemployment, and power shortages, fuels significant public discontent. Critics argue that these funds could be better utilized to alleviate domestic suffering, invest in vital infrastructure, or stabilize the national currency. This prioritization of regional influence and strategic depth over the immediate welfare of its own citizens highlights a fundamental tension within the regime's governance. It underscores the complex interplay between foreign policy ambitions and domestic economic realities, making the resolution of the economic crisis in Iran even more challenging as long as these priorities remain unchanged.Navigating a Complex Future: Prospects for Iran's Economy

The path forward for Iran's economy is fraught with immense challenges, requiring a delicate balance of internal reforms, external diplomacy, and a strategic re-evaluation of national priorities. The interconnectedness of energy market shocks, persistent inflation, and geopolitical risks creates a volatile environment that offers few easy solutions. For Iran to emerge from its deepest economic crisis, it would likely require a significant shift in its relationship with the international community, potentially involving a renegotiation of sanctions relief in exchange for verifiable commitments. Domestically, the regime faces the unenviable task of implementing painful but necessary economic reforms, such as rationalizing subsidies and combating corruption, without triggering widespread social unrest. Diversifying the economy away from oil dependency, fostering a more robust private sector, and attracting foreign investment are long-term goals that seem distant given the current climate. The prospect of continued regional conflict only adds to the uncertainty, as it diverts resources and deters potential economic partners. Ultimately, the future trajectory of the economic crisis in Iran will depend on a complex interplay of political will, international dynamics, and the resilience of its people in the face of unprecedented adversity.Conclusion

The current economic crisis in Iran represents a confluence of deeply entrenched issues, from crippling international sanctions and structural economic weaknesses to internal mismanagement and a persistent energy paradox. As of late 2024, the nation finds itself in an unprecedented downturn, with the specter of hyperinflation and widespread unrest looming large. The difficult choices facing the clerical regime—balancing geopolitical ambitions with the urgent needs of its struggling populace—underscore the complexity of the situation. While the immediate future remains uncertain, it is clear that a sustainable path forward for Iran's economy will require fundamental shifts in policy, both domestically and internationally. We hope this comprehensive analysis has provided valuable insights into the multifaceted nature of the economic crisis in Iran. What are your thoughts on the most critical factor contributing to Iran's economic woes? Do you believe there's a viable path to recovery in the near term? Share your perspectives in the comments below, and don't forget to share this article with others who might be interested in understanding this complex geopolitical and economic challenge. For more in-depth analysis of global economic trends and geopolitical developments, explore other articles on our site.- Peter Zeihans Wife Who Is She

- Kevin Surratt Jr An Insight Into His Marriage With Olivia

- Ann Neal Leading The Way In Home Design Ann Neal

- Watch Movies And Shows For Free With A Netflix Account

- The Renowned Actor Michael Kitchen A Master Of Stage And Screen

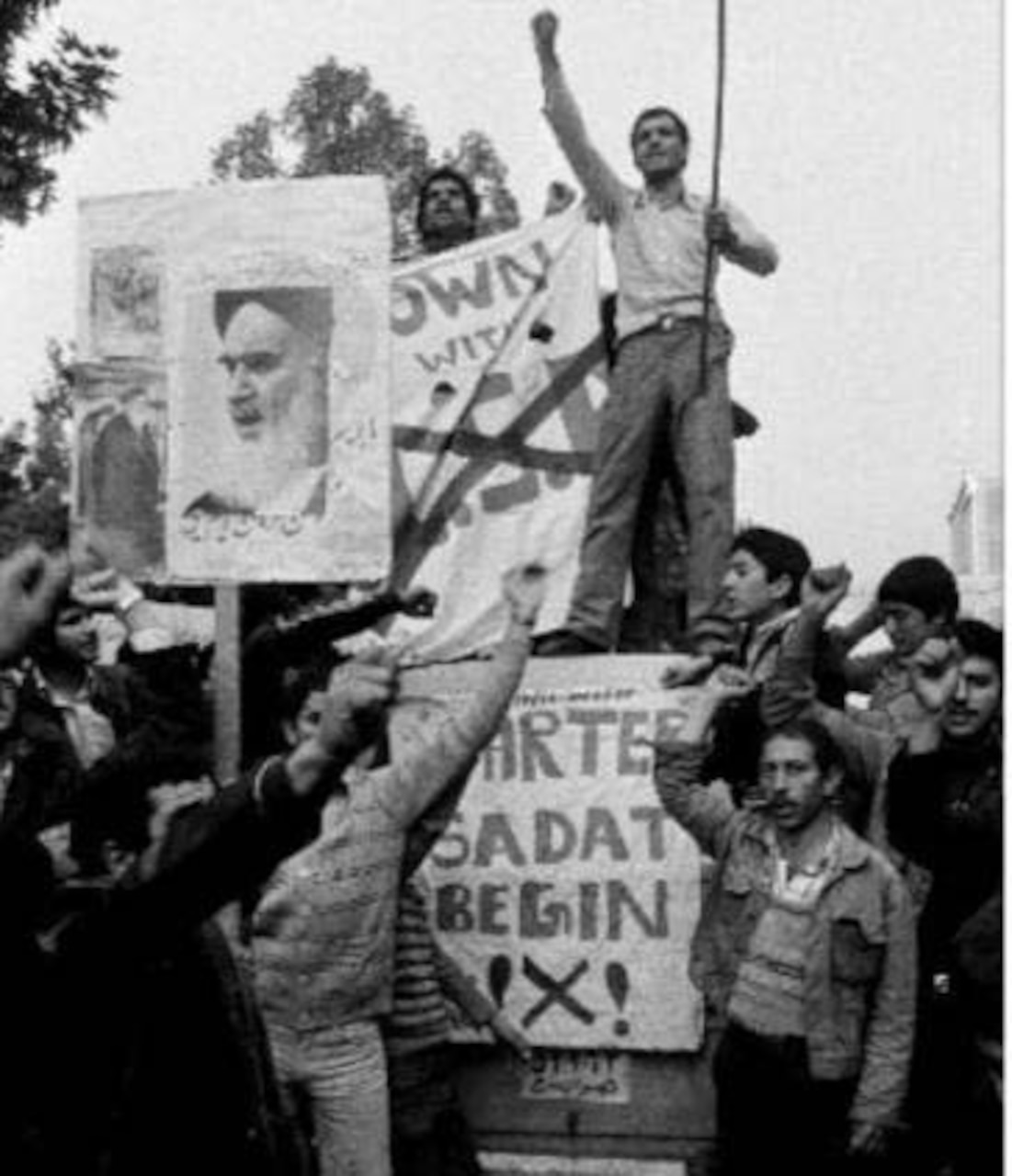

Iran Hostage Crisis Fast Facts - CNN

40 Years After Hostage Crisis, Iran Remains Hotbed of Terrorism > U.S

6 things you didn't know about the Iran hostage crisis - CNN