US Funds To Iran: The Truth Behind The Billions

Table of Contents

- Unpacking the Myth: Was it $150 Billion or $16 Billion?

- The Joint Comprehensive Plan of Action (JCPOA) and Frozen Assets

- Iran's Financial Landscape Post-JCPOA

- The 2023 Prisoner Exchange and the $6 Billion Release

- The Hamas Attacks and the $6 Billion Controversy

- Sanctions Waivers and Oil Exports: Other Financial Flows

- The Future of US-Iran Financial Relations

- Conclusion

Unpacking the Myth: Was it $150 Billion or $16 Billion?

One of the most enduring myths surrounding US financial interactions with Iran is the claim that the United States "gave $150 billion to Iran" in 2015. This figure has been widely circulated, often without context, and has become a cornerstone of criticism against the Joint Comprehensive Plan of Action (JCPOA), commonly known as the Iran nuclear deal. However, it is crucial to clarify that the United States did not give $150 billion to Iran in 2015. This figure represents an estimate of Iran's total frozen assets globally, not a direct payment from the US treasury. The nuclear deal gave Iran access to these funds, which were already theirs, but the US did not transfer this sum. More recently, claims have surfaced questioning, "Did President Joe Biden give $16 billion of American money away to Iran in 2023?" This figure, too, is inaccurate. First, it's important to say that the amount in question is $6 billion, not $16 billion. The repeated exaggeration of these figures, whether $150 billion or $16 billion, serves to inflame public opinion and distort the true nature of the financial arrangements. These sums were not "American money" given away, but rather Iranian assets that were unfrozen as part of specific agreements, a critical distinction when discussing how much money did US give to Iran.The Joint Comprehensive Plan of Action (JCPOA) and Frozen Assets

To understand the financial flows, we must first look at the context of the 2015 nuclear deal. In 2015, as part of an international deal with Iran called the Joint Comprehensive Plan of Action (JCPOA), Iran agreed to cut back on nuclear activities in exchange for sanctions relief. This agreement was not about the US giving Iran money from its own coffers. Instead, it was about allowing Iran to access its own funds that had been frozen in banks around the world due to international sanctions. In return, five Iranians held in the United States were also allowed to leave, and — crucially — $6 billion in previously frozen Iranian assets was freed up. Beyond the initial unfreezing of assets, there was a specific payment that also drew significant attention. After implementation of the Iran deal, the United States sent $1.7 billion to Iran. This payment was widely scrutinized and became a point of contention, particularly regarding its timing and purpose.Was the $1.7 Billion a Ransom Payment?

The $1.7 billion payment made by the United States to Iran shortly after the JCPOA's implementation sparked intense debate, with many questioning its nature. Some are now claiming this was a ransom payment for the return of American citizens that were being held hostage by Iran. The Iran deal included a ransom payment for hostages, the facts of which are still debated. However, US officials at the time stated that the $1.7 billion was the settlement of a long-standing financial dispute related to a pre-1979 arms deal. Iran had paid for military equipment that was never delivered after the Iranian Revolution. The payment consisted of $400 million in principal, which had been held in a trust fund since 1979, plus $1.3 billion in accrued interest. While the timing coincided with the release of American prisoners, the US government maintained it was a legitimate settlement of a financial claim, not a direct ransom. The controversy, however, highlights the deep mistrust and differing interpretations surrounding any financial interaction that addresses how much money did US give to Iran.Iran's Financial Landscape Post-JCPOA

The implementation of the JCPOA undeniably had a significant impact on Iran's economic situation. The JCPOA infused Iran with cash by unfreezing billions of dollars in assets held abroad and lifting sanctions on its oil exports and banking sector. This influx of funds provided a much-needed boost to an economy that had been severely constrained by years of international sanctions. Prior to the reimposition of sanctions, Iran's central bank controlled more than $120 billion in foreign exchange reserves. This figure underscores the substantial financial resources that Iran possessed, much of which was inaccessible due to sanctions. The nuclear deal provided a pathway for Iran to regain access to these funds, enabling it to engage more freely in international trade and finance. However, this period of economic relief was relatively short-lived. Right before the United States reimposed sanctions in 2018 under the Trump administration, Iran's central bank controlled more than $120 billion in foreign exchange reserves. The reimposition of sanctions once again severely restricted Iran's access to its foreign currency reserves, leading to renewed economic hardship.The 2023 Prisoner Exchange and the $6 Billion Release

Fast forward to 2023, and another significant financial arrangement between the US and Iran came under intense scrutiny. About two months ago, President Biden agreed to hand over $6 billion as a part of a hostage deal with Tehran. This deal involved a prisoner exchange where five Americans who had been imprisoned in Iran were allowed to go home. In return, the Iranian government now has access to $6 billion of their funds to be used for humanitarian purposes as a part of a wider deal. It is crucial to understand the nature of these funds. This $6 billion was not "new" money from the US treasury. These were Iranian funds that had been held in restricted accounts in South Korea due to US sanctions. The funds were held in Korean currency and did not earn interest, according to the Central Bank of Iran, and the won’s depreciation in recent years shaved off about $1 billion in value, leaving around $6 billion today. The agreement stipulated that these funds would be transferred to Qatar and held in a restricted account, with strict oversight to ensure they are used solely for humanitarian purposes, such as purchasing food, medicine, and agricultural products. This measure was intended to prevent the funds from being diverted to other uses, addressing concerns about how much money did US give to Iran and its potential misuse.The Hamas Attacks and the $6 Billion Controversy

The release of the $6 billion became highly controversial, particularly following the unprecedented attacks on Israel by Hamas on October 7th, 2023. Shortly after, Hamas, which receives hundreds of millions of dollars from Iran annually, launched an unprecedented and horrific attack on Israel on October 7th. This timing immediately led to widespread speculation and accusations, with many questioning whether the unfrozen funds had directly or indirectly contributed to the attacks. Republicans have sought to link $6 billion in unfrozen Iranian funds to the weekend attacks on Israeli civilians. The Biden administration and the State Department have vehemently denied any direct link. The State Department insists that none of the $6 billion recently released to Iran by the U.S. in a prisoner exchange was used to fund the Hamas attack on Israel. They reiterated that the funds were still in a restricted account in Qatar and had not yet been accessed by Iran for any purchases. However, the optics of the situation were challenging, as evidenced by the sentiment, "But it sure doesn’t look good." The claim that "one of the reasons Israel was attacked by Hamas was that Biden gave $6 billion in ransom money to Iran" became a powerful narrative, despite official denials. The debate over how much money did US give to Iran thus became entangled with the broader geopolitical conflict.The Nexus of Funding and Terrorism Concerns

The concern that unfrozen Iranian assets could indirectly bolster its support for proxy groups and terrorist organizations is a long-standing one. Critics argue that even if the $6 billion is used for humanitarian purposes, it frees up other Iranian funds that can then be diverted to military or illicit activities. Some of the money freed in 2015 may have allowed Iran to provide funding for terrorist groups, but there’s not enough concrete evidence to say the money freed in the agreement directly went to. This highlights the inherent difficulty in tracing funds and proving direct causation, especially when dealing with a state that has a history of supporting non-state actors. Social media posts often distort the sources of the money to create a more sensational and politically charged narrative. It's crucial to differentiate between Iran's overall financial capacity and specific funds released under strict conditions. While Iran undoubtedly funds groups like Hamas, the direct link to the $6 billion released in 2023 remains unsubstantiated by official reports. The debate continues to rage, with political figures and analysts offering differing perspectives on the potential indirect impacts of any financial relief to Iran.Sanctions Waivers and Oil Exports: Other Financial Flows

Beyond the high-profile prisoner exchange deals, other financial flows and mechanisms influence Iran's economic standing, often involving US policy decisions. One such mechanism involves sanctions waivers. Secretary of State Antony Blinken determined on November 8 that it is in the national security interest of the United States to waive mandatory economic sanctions that bar Iraq from transferring electricity payments to Iran. These waivers allow Iran to receive payments for electricity exports to Iraq, providing another source of revenue. Furthermore, Iran's oil exports have seen fluctuations based on US policy. Under the Trump administration’s “maximum pressure” strategy, Iran averaged 775,000 barrels per day. However, under the current administration, this has significantly increased. This is up 80% from the 775,000 barrels per day Iran averaged under the Trump administration’s “maximum pressure” strategy, according to United Against Nuclear Iran, the group of former U.S. officials. Increased oil exports translate directly into more revenue for the Iranian government, regardless of whether it originates from direct US payments or from other countries purchasing Iranian oil. This broader context is essential when discussing the overall financial strength of Iran and how much money did US give to Iran, indirectly or directly.Iran's UN Dues and Other Uses

It's also worth noting that Iran has utilized small amounts of its unfrozen funds for routine international obligations. Iran also tapped into small amounts of that money to pay its UN dues several times. This detail, though minor in the grand scheme of billions, illustrates that some of Iran's unfrozen assets are indeed used for legitimate, albeit small, international financial responsibilities. It further reinforces the point that these are Iranian assets, not a blank check from the US. These small transactions rarely make headlines but are part of the larger picture of how Iran manages its international finances when sanctions allow it access to its funds.The Future of US-Iran Financial Relations

The question of how much money did US give to Iran remains a politically charged issue, with significant implications for future policy. The Biden administration has chosen not to block the $6 billion it promised Iran after a prisoner swap this year, despite politicians’ calls to do so after Hamas’ attack on Israel. This decision reflects a complex balancing act between humanitarian concerns, diplomatic agreements, and geopolitical realities. The administration's stance is that reneging on the deal would undermine future diplomatic efforts and potentially endanger other American citizens held abroad. Looking ahead, the political landscape in the US could significantly alter the approach to Iran's access to funds. With Trump’s return to the presidency imminent, his incoming administration will face the decision of whether to allow Iran continued access to these funds. A change in administration could lead to a renewed "maximum pressure" campaign, potentially freezing these funds once again and imposing new sanctions, further complicating the question of how much money did US give to Iran or allow Iran to access.Navigating Complex Geopolitics

The financial relationship between the US and Iran is inextricably linked to broader geopolitical tensions, nuclear ambitions, regional stability, and human rights concerns. Each financial transaction, whether it's the unfreezing of assets, a settlement payment, or a sanctions waiver, is a piece of a much larger, intricate puzzle. Understanding these dynamics requires looking beyond sensational headlines and delving into the specific agreements, the nature of the funds, and the stated purposes of their release. The ongoing debate over how much money did US give to Iran is a microcosm of the challenges in managing one of the world's most complex and volatile international relationships.Conclusion

The narrative surrounding "how much money did US give to Iran" is often oversimplified and misrepresented. The reality is that the United States has not directly "given" billions of dollars of American taxpayer money to Iran. Instead, the financial interactions primarily involve the unfreezing of Iran's own assets, which were held in foreign banks due to international sanctions, as part of diplomatic agreements like the JCPOA or prisoner exchanges. Key figures like the alleged $150 billion in 2015 and the $16 billion in 2023 are largely mischaracterizations; the actual amounts involved in specific agreements were closer to $6 billion in unfrozen assets and a $1.7 billion settlement payment. While concerns about Iran's use of funds to support malign activities are valid and continuously monitored, official statements confirm that the recently unfrozen $6 billion for humanitarian purposes has remained under strict oversight and was not directly used in the Hamas attacks. The complex interplay of sanctions, diplomatic deals, and geopolitical events shapes these financial flows. For a comprehensive understanding, it's vital to rely on factual reporting and official statements rather than distorted social media claims. We hope this detailed breakdown has provided clarity on a frequently misunderstood topic. What are your thoughts on the complexities of US-Iran financial relations? Share your insights in the comments below, and consider exploring other articles on our site for more in-depth analyses of international policy and finance.- Katiana Kay Full Video Uncensored And Explicit

- Best 5movierulz Kannada Movies Of 2024 A Guide To The Mustwatch Films

- Shag Carpet Installation Your Ultimate Guide To Easy Home Upgrades

- The 5 Golden Rules Of Kannada Cinema On Moviecom

- An Unforgettable Journey With Rising Star Leah Sava Jeffries

U.S. Sent Cash to Iran as Americans Were Freed - WSJ

With Inflation Ravaging Currency, Iran Is Changing Names and Numbers

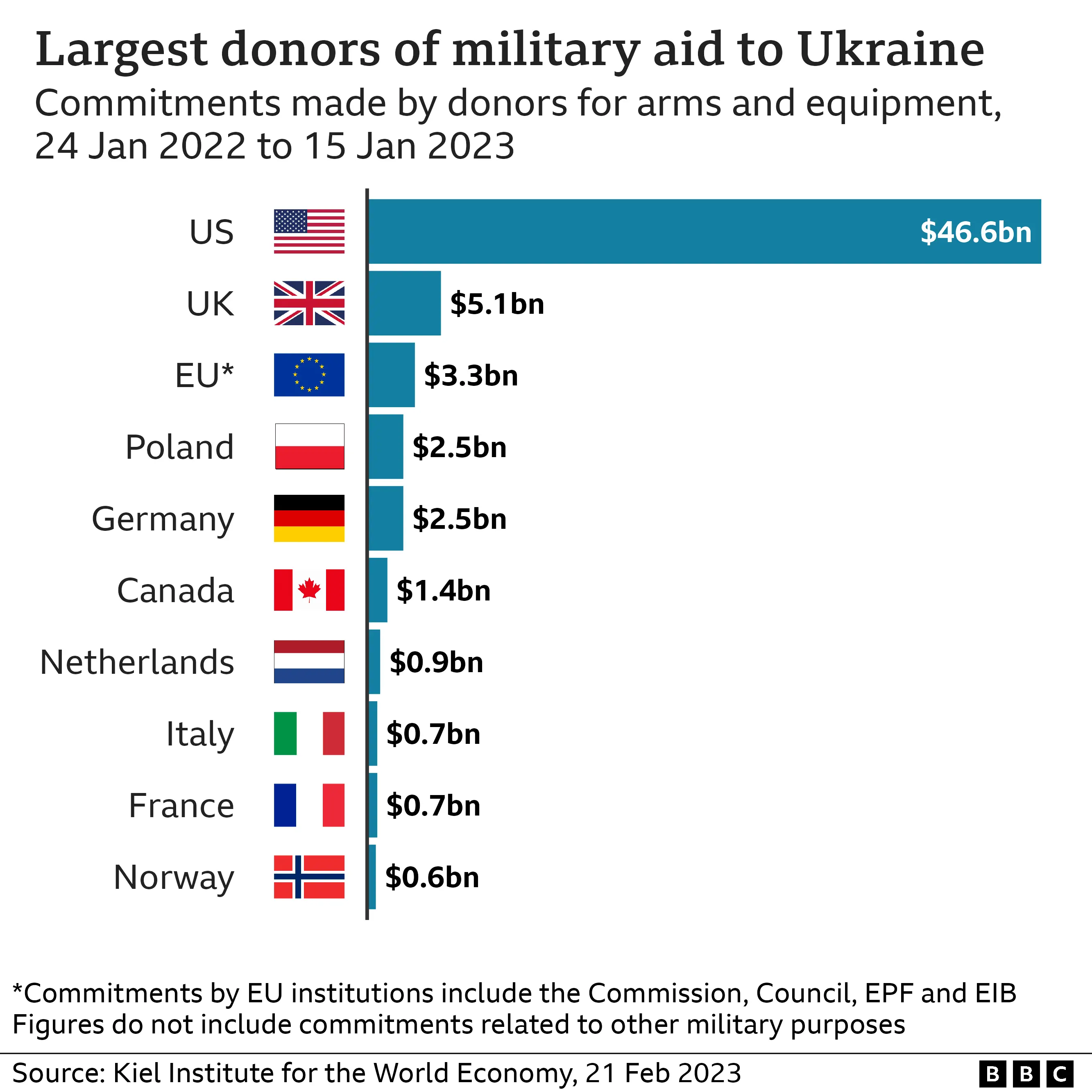

How much money has the US given to Ukraine?