OFAC Iran: Navigating The Complex Web Of Sanctions

The intricate world of international finance and geopolitics often intersects with powerful regulatory bodies, and few are as impactful as the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC). When it comes to Iran, OFAC stands at the forefront of implementing and enforcing a comprehensive sanctions program designed to exert economic pressure. Understanding the nuances of OFAC Iran sanctions is crucial for businesses, financial institutions, and individuals worldwide, as non-compliance can lead to severe penalties.

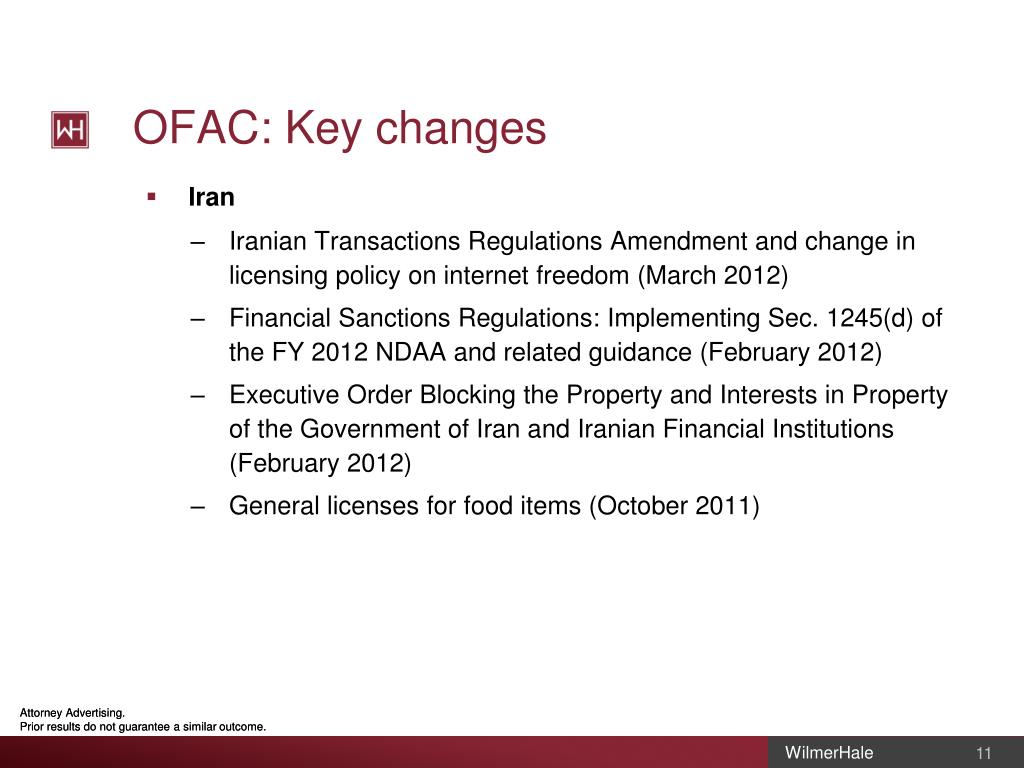

OFAC provides essential guidance, advisories, and detailed information on these sanctions programs and related policies for Iran. This includes everything from the specific types of sanctions imposed to the rare exceptions and the stringent licensing requirements. The landscape is constantly evolving, marked by new designations, updated advisories, and ongoing enforcement actions, making continuous vigilance paramount for anyone operating in or connected to the global financial system.

Understanding OFAC's Role in Iran Sanctions

The Office of Foreign Assets Control (OFAC) is a financial intelligence and enforcement agency of the U.S. Treasury Department. It administers and enforces economic and trade sanctions based on U.S. foreign policy and national security goals. When it comes to Iran, OFAC's mandate is broad, covering a wide array of activities that could directly or indirectly benefit the Iranian government or its sanctioned entities. This involves not just U.S. persons and entities, but also, significantly, foreign financial institutions, individuals, and entities that engage in transactions with Iran.

- Discerning Jelly Bean Brains Leaked Videos An Expos

- Mary Trumps Surprising Net Worth Revealed

- The Renowned Actor Michael Kitchen A Master Of Stage And Screen

- The Allure Of Camilla Araujo Fapello A Starlets Rise To Fame

- Watch Movies And Shows For Free With A Netflix Account

OFAC provides comprehensive guidance, advisories, and information on the sanctions programs and related policies for Iran. This ensures that businesses and individuals can learn about the specific sanctions, understand the limited exceptions, navigate the complex licensing processes, and be aware of potential enforcement actions. The goal is to prevent Iran from accessing funds and resources that could be used to support its destabilizing activities, including its nuclear program, ballistic missile development, and support for terrorism.

The "Maximum Pressure" Campaign: A Strategic Overview

A significant phase in the history of OFAC Iran sanctions was the "maximum pressure" campaign. This strategy was formalized by National Security Presidential Memorandum 2, which ordered a concerted campaign to exert unprecedented economic pressure on Iran. A key instrument in this campaign was Executive Order (E.O.) 13902. This executive order specifically targets Iran’s financial, petroleum, and petrochemical sectors, aiming to choke off the primary sources of revenue for the Iranian government.

The implementation of E.O. 13902 has led to numerous designations, imposing severe restrictions on anyone operating within or transacting with these critical Iranian economic sectors. The intent is to make it exceedingly difficult for Iran to conduct international trade and access foreign currency, thereby limiting its ability to fund its strategic objectives. This aggressive approach underscores the U.S. commitment to isolating Iran economically until it alters its behavior on the international stage.

- The Legendary Virginia Mayo Hollywoods Glamorous Star

- Linda Gray A Legendary Actress And Advocate

- Felicity Blunt The Eminent British Actress And Producer

- The Ultimate Guide To Accessing Netflix For Free Unlock Hidden Accounts

- Stefania Ferrario An Inspiring Entrepreneur

Targeting Key Economic Sectors

Beyond the well-known petroleum and petrochemical industries, E.O. 13902 also imposes sanctions with respect to any person determined by the Secretary of the Treasury to operate in the construction, mining, manufacturing, and textiles sectors of the Iranian economy. This broad scope demonstrates a deliberate effort to target multiple facets of Iran's economic infrastructure, ensuring that pressure is applied across various industries that contribute to the government's financial well-being. The Secretary of the Treasury, in consultation with the Secretary of State, retains the authority to identify and designate additional sectors of the Iranian economy for sanctions, maintaining flexibility in the maximum pressure strategy.

This multi-sectoral approach means that businesses, regardless of their direct involvement in oil, must exercise extreme caution when dealing with Iranian entities. Any engagement that could be deemed as operating within or providing material support to these sanctioned sectors could lead to designation and severe penalties under OFAC Iran regulations.

Unmasking Illicit Networks: OFAC's Enforcement Actions

A significant part of OFAC's work involves identifying and disrupting illicit financial networks that Iran uses to circumvent sanctions. These networks often employ sophisticated methods, including shadow banking operations, front companies, and complex money laundering schemes. OFAC regularly designates individuals and entities involved in these illicit activities, exposing their methods and cutting off their access to the international financial system.

For instance, the Department of the Treasury's OFAC has designated over 30 individuals and entities tied to Iranian brothers Mansour, Nasser, and Fazlolah Zarringhalam. These individuals collectively laundered billions of dollars through a sprawling network, highlighting the scale and complexity of the evasion tactics employed. Similarly, OFAC has sanctioned nearly 50 entities and individuals constituting multiple branches of a "shadow banking" network used by Iran’s Ministry of Defense and Armed Forces Logistics (MODAFL) and the Islamic Revolutionary Guard Corps (IRGC) to gain illicit access to international finance. These actions demonstrate OFAC's relentless pursuit of those who enable Iran's illicit financial activities.

The Perilous Path of Oil Smuggling and Evasion

Iranian oil smuggling remains a persistent challenge for OFAC. The updated FinCEN advisory highlights Iranian oil smuggling, shadow banking, and weapons procurement typologies, indicating the interconnectedness of these illicit activities. OFAC has been particularly active in targeting networks facilitating the shipment of Iranian crude oil, often worth hundreds of millions of dollars, to foreign markets, particularly the People's Republic of China (PRC). This oil is frequently shipped on behalf of Iran’s Armed Forces General Staff (AFGS) and its sanctioned fronts, directly underwriting their operations.

Recent enforcement actions include the designation of a "teapot" oil refinery and its chief executive officer for purchasing and refining hundreds of millions of dollars’ worth of Iranian crude oil, including from vessels linked to sanctioned entities like Ansarallah (the Houthis). OFAC has also sanctioned nearly two dozen firms operating in multiple jurisdictions, involved in virtually every aspect of Iran’s illicit international oil trade. The Iranian government allocates billions of dollars’ worth of oil annually to its armed forces to supplement their budget allocations, making the disruption of this trade a high priority for OFAC Iran sanctions.

Notable individuals targeted in this effort include Iran’s Minister of Petroleum, Mohsen Paknejad, who oversees the export of tens of billions of dollars’ worth of Iranian oil and has allocated billions to the armed forces. OFAC also designated Iranian national and liquefied petroleum gas (LPG) magnate Seyed Asadoollah Emamjomeh and his corporate network for shipping hundreds of millions of dollars’ worth of Iranian LPG and crude oil to foreign markets. These designations underscore OFAC's focus on key enablers and facilitators of Iran's energy exports.

Navigating the Sanctions Landscape: Exceptions and Licensing

While OFAC Iran sanctions are comprehensive, certain humanitarian and informational exceptions exist. It is crucial to understand that these are narrow and require strict adherence to regulations, often necessitating an OFAC license. For instance, importing from Iran or exporting to Iran anything outside of informational materials or humanitarian donations generally requires an OFAC license, as per § 560.315. Personal items brought for personal use during travel are typically an exception.

A critical exception pertains to payments for licensed sales of agricultural commodities, medicine, and medical devices. These transactions must explicitly reference an appropriate OFAC license. Furthermore, such payments may not involve a debit or credit to an account of a person in Iran or a financial institution on a government restricted party list, emphasizing the need for careful financial routing and due diligence even for permissible transactions. These exceptions are designed to mitigate the humanitarian impact of sanctions while maintaining pressure on the Iranian government.

The Global Ripple Effect: Impact on Foreign Entities

The reach of OFAC Iran sanctions extends far beyond U.S. borders, significantly impacting foreign financial institutions, individuals, and entities. Non-U.S. persons can face severe penalties, including being cut off from the U.S. financial system, if they facilitate significant transactions for sanctioned Iranian entities or engage in activities that violate U.S. sanctions. This extraterritorial reach necessitates that foreign entities conduct thorough due diligence and implement robust compliance programs to avoid inadvertent violations.

Transferring funds to an Iranian financial institution or to an individual or entity on one of the government restricted party lists is a prime example of an activity that can trigger sanctions for foreign parties. This means that banks, businesses, and individuals globally must be acutely aware of who they are transacting with and the ultimate beneficiary of any funds or goods, especially when there is an Iranian nexus. The risk of being designated or facing secondary sanctions is a powerful deterrent for engaging in prohibited activities.

Identifying Restricted Parties: The SDN List

Central to OFAC's enforcement is the Specially Designated Nationals (SDN) List. This list identifies individuals and entities with whom U.S. persons are generally prohibited from dealing, and whose assets are blocked. For foreign entities, transactions involving SDNs can also lead to significant risks. OFAC regularly updates its SDN list, adding new individuals and entities as they are identified as facilitators or beneficiaries of illicit Iranian activities. Examples of individuals added to OFAC's SDN list include Mehdi and Fatemeh Sarlak Kuhi, based in Tehran, Iran, among many others.

Businesses must routinely screen their customers, partners, and transactions against the SDN list and other restricted party lists to ensure compliance. Failure to do so can result in severe financial penalties, reputational damage, and even criminal charges. The dynamic nature of these lists requires continuous monitoring and adaptation of compliance protocols.

OFAC's Vigilance: Advisories for Stakeholders

To assist stakeholders in navigating the complex sanctions environment, OFAC regularly issues advisories highlighting specific risks and evasion tactics. These advisories serve as critical warnings and provide guidance on how to detect and mitigate exposure to illicit activities. For instance, the Department of the Treasury's OFAC has issued an advisory for shipping and maritime stakeholders on detecting and mitigating Iranian oil sanctions evasion. This advisory details common deceptive practices used by Iran to disguise the origin of its oil, such as ship-to-ship transfers, disabling AIS transponders, and using false documentation.

Similarly, the updated FinCEN advisory highlights Iranian oil smuggling, shadow banking, and weapons procurement typologies. These advisories are invaluable resources for financial institutions, shipping companies, insurers, and other businesses that might inadvertently become involved in illicit Iranian trade. They underscore the U.S. government's commitment to transparency regarding evasion methods and its expectation that industry stakeholders implement robust due diligence measures to counter these threats.

Case Studies in Enforcement: Recent Designations

OFAC's enforcement actions provide concrete examples of the types of activities that lead to sanctions and the networks targeted. Beyond the Zarringhalam brothers and the MODAFL/IRGC shadow banking network, OFAC has recently sanctioned numerous other entities and individuals. These include international networks facilitating the shipment of millions of barrels of Iranian crude oil to the PRC, often on behalf of Iran's armed forces. Oil brokers in the United Arab Emirates (UAE) and Hong Kong have also been designated for their roles in these illicit schemes, demonstrating the global reach of these networks.

The designation of a "teapot" oil refinery and its CEO for purchasing and refining Iranian crude oil, including from vessels linked to the Houthis, illustrates OFAC's focus on every link in the illicit supply chain. Furthermore, the sanctioning of nearly two dozen firms operating in multiple jurisdictions, involved in various aspects of Iran’s illicit international oil trade, highlights the comprehensive nature of these enforcement efforts. These actions send a clear message that any entity or individual supporting Iran's sanctioned sectors will face severe consequences.

Beyond Oil: Other Sanctioned Sectors and Individuals

While oil and finance often dominate headlines, OFAC Iran sanctions extend to other vital sectors. Executive Order 13902 specifically targets the construction, mining, manufacturing, and textiles sectors of the Iranian economy. This means that businesses dealing with Iranian entities in these areas must also exercise extreme caution. OFAC's proactive approach includes designating individuals like Mohsen Paknejad, Iran’s Minister of Petroleum, who oversees the export of tens of billions of dollars’ worth of Iranian oil and allocates significant funds to Iran’s armed forces, as well as Seyed Asadoollah Emamjomeh, an LPG magnate. These designations reinforce the breadth of OFAC's focus beyond just the physical movement of oil to the individuals and corporate structures that facilitate it.

The continuous updates to the SDN list, including individuals from various regions within Iran like Pob Dehdasht, Kohgiluyeh County, further emphasize the granular level at which OFAC identifies and targets individuals and entities involved in prohibited activities. This layered approach aims to dismantle the entire ecosystem that supports Iran's sanctioned programs.

Staying Compliant: Best Practices for Businesses

For any entity involved in international trade or finance, especially with potential connections to the Middle East, understanding and complying with OFAC Iran sanctions is paramount. This involves:

- Robust Due Diligence: Thoroughly vet all counterparties, including customers, suppliers, and financial intermediaries, to identify any direct or indirect links to sanctioned entities or activities.

- Sanctions Screening: Implement automated systems for screening names against OFAC's SDN list and other relevant restricted party lists on an ongoing basis.

- Understanding Licensing Requirements: Be aware of the specific circumstances under which licenses may be granted for humanitarian or other permissible activities, and strictly adhere to their terms.

- Geographic Awareness: Recognize that certain regions or jurisdictions (e.g., UAE, Hong Kong, PRC, as highlighted in the data) may be high-risk for facilitating Iranian sanctions evasion.

- Internal Controls: Establish strong internal controls and compliance policies to prevent, detect, and report potential violations.

- Training: Regularly train employees on OFAC regulations, red flags for evasion, and internal reporting procedures.

- Staying Informed: Continuously monitor OFAC's website, press releases, and advisories for updates to sanctions programs and new designations. For more information, always refer to Treasury’s press releases.

Proactive compliance is not just about avoiding penalties; it's about safeguarding your business's reputation and integrity in the global marketplace. The complexities of OFAC Iran sanctions demand a vigilant and informed approach.

Conclusion

The OFAC Iran sanctions program is a dynamic and far-reaching instrument of U.S. foreign policy, designed to exert maximum economic pressure on the Iranian government. From targeting key economic sectors like petroleum and finance to actively dismantling illicit shadow banking networks and oil smuggling operations, OFAC's enforcement actions are relentless. While limited exceptions exist for humanitarian aid and certain licensed transactions, the overarching message is clear: engaging with sanctioned Iranian entities or facilitating their prohibited activities carries significant risks for individuals and organizations worldwide.

Navigating this complex landscape requires unwavering vigilance, robust compliance frameworks, and a deep understanding of the evolving regulations. By staying informed, implementing strong due diligence, and adhering to OFAC's guidance, businesses and financial institutions can protect themselves from severe penalties and contribute to the integrity of the international financial system. Do you have experiences or insights into navigating these complex sanctions? Share your thoughts in the comments below, or explore other articles on our site for more insights into global compliance challenges.

- Uncovering Tony Hinchcliffes Instagram Connection

- Discover The Ultimate Guide To Purchasing An Onlyfans Account

- Unveiling The Marital Life Of Joseph Gilgun Who Is His Wife

- The Legendary Teddy Riley An Rb Trailblazer

- Is Kim Kardashian Expecting A Baby With Travis Kelce Inside The Pregnancy Rumors

Ofac iran sanctions - topcommon

Ofac general license iran - operfskin

Ofac iran sanctions act - paasleads