USD To Iranian Rial: Unraveling Iran's Complex Currency Dynamics

The intricate relationship between the US Dollar (USD) and the Iranian Rial (IRR) is far more than just a simple currency exchange rate; it's a barometer of Iran's economic health, geopolitical tensions, and the daily struggles of its citizens. For anyone looking to understand, convert, or simply track the value of the USD Iranian Rial, delving into its unique dynamics is essential. This comprehensive guide aims to demystify the complexities surrounding this critical currency pair, providing insights into its current standing, historical trends, and the underlying factors that drive its often volatile movements.

Whether you're an investor, a traveler, or simply curious about global economics, the USD to Iranian Rial exchange rate presents a fascinating, albeit challenging, case study. Unlike many other major currency pairs, the IRR operates under a unique set of circumstances, heavily influenced by international sanctions, domestic policies, and a vibrant parallel market. Understanding these nuances is key to grasping the true value and implications of the Iranian Rial against the world's reserve currency, the US Dollar.

Table of Contents

- Understanding the USD to Iranian Rial Exchange Rate

- Historical Trends: A Decade of Dynamics for the Iranian Rial

- Why Does the USD Iranian Rial Rate Fluctuate So Much?

- The Strength Factor: USD vs. Iranian Rial

- Accessing Real-Time Data and Tools for USD IRR

- Navigating the Iranian Rial: Practical Considerations

- The Future Outlook for the USD Iranian Rial

Understanding the USD to Iranian Rial Exchange Rate

The fundamental concept of the USD to Iranian Rial exchange rate, like any other currency pair, tells you how many Iranian Rials you can get for one US Dollar. However, in Iran's case, this seemingly simple concept is complicated by the existence of multiple exchange rates. Typically, when you search for "current US Dollar Iranian Rial rate," you might encounter an official rate, often set by the Central Bank of Iran, and a significantly different "open market" or "free market" rate. For instance, as of recent data, the official exchange rate might hover around 42,125 Iranian Rials for 1 US Dollar. This rate is often used for specific government transactions, essential imports, or by banks for limited purposes. Conversely, the open market rate, which reflects the true supply and demand dynamics influenced by sanctions, inflation, and political events, can be dramatically higher. Recent figures indicate that in the open market, 1 US Dollar could be exchanged for as much as 938,000 Iranian Rials, a stark contrast that highlights the economic pressures at play. This dual-rate system is a critical aspect to grasp when dealing with the USD Iranian Rial. The sheer disparity between these rates underscores the challenges faced by both individuals and businesses within Iran, making accurate and up-to-date information invaluable. Understanding which rate applies to your specific needs is paramount to making informed financial decisions.The Official vs. Open Market Rate: A Crucial Distinction

The existence of both an official and an open market rate for the USD Iranian Rial is a direct consequence of Iran's unique economic and political landscape. The official rate, often quoted at around 42,125 IRR to 1 USD, is a fixed or semi-fixed rate primarily used for government-approved transactions, such as the import of essential goods like medicine and food. This rate is a mechanism for the government to subsidize critical imports and manage the flow of foreign currency for strategic purposes. However, for most ordinary citizens, businesses engaged in non-essential trade, and those seeking foreign currency for travel or savings, the official rate is largely inaccessible. Instead, they rely on the open market, where the rate is determined by market forces, albeit heavily influenced by external pressures and internal policies. The open market rate, which recently surged to 938,000 IRR for 1 USD, reflects the real demand for hard currency and the impact of inflation and sanctions. This significant gap between the two rates creates arbitrage opportunities, but also fuels corruption and complicates economic planning. It means that while the official rate might appear stable, the true cost of the dollar for most Iranians is vastly higher, leading to significant purchasing power erosion and economic instability. This duality is a constant source of discussion and concern within Iran's economic circles, putting immense pressure on policymakers.How to Convert USD to Iranian Rial

Converting US Dollars to Iranian Rials, or vice versa, is straightforward with the right tools, though understanding which rate applies is key. Online currency converters are the most accessible way to get an immediate estimate. Services like the Universal Currency Converter allow you to easily "get the latest 1 US Dollar to Iranian Rial rate for free." The process is intuitive: you simply "type in the box how much you want to convert," then "click on the dropdown to select USD in the first dropdown as the currency that you want to convert and IRR in the second dropdown as the currency you want to convert to." For instance, if you want to know "how to convert US Dollars to Iranian Rial," these tools will instantly show you the equivalent value based on their provided rate. It's important to note that these converters typically reflect a market rate, which might be closer to the open market rate than the official government rate, depending on the data source. They also provide features like "USD to IRR currency charts," allowing you to "pair exchange rate history for up to 10 years." This historical data is invaluable for understanding trends, such as whether "the US Dollar is up or down against the Iranian Rial over the past 10 years." For practical transactions, especially within Iran, the actual rate you receive will depend on where you exchange the currency—be it an official bank (where access might be limited) or a money changer in the open market. Always check the "live Iranian Rial (IRR) exchange rates" just before any transaction to ensure you're working with the most current figures.Historical Trends: A Decade of Dynamics for the Iranian Rial

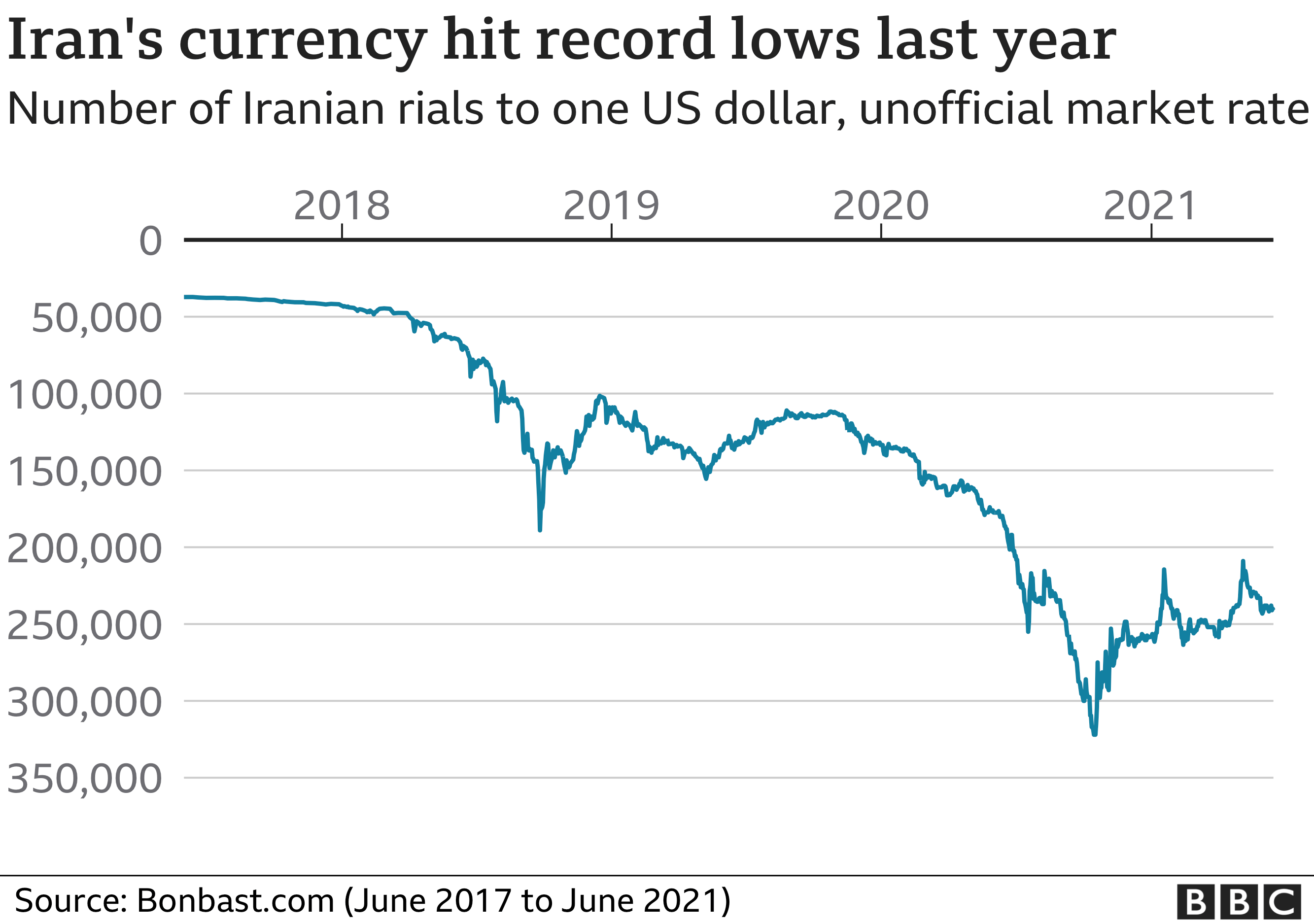

The past decade has been a period of immense volatility and significant depreciation for the Iranian Rial against the US Dollar. A glance at "Xe's free live currency conversion chart for US Dollar to Iranian Rial" reveals a dramatic weakening of the IRR. While specific historical rates are not fully detailed in the provided data, the mention of "exchange rate history for up to 10 years" and the phrase "over the past 10 years, the..." (implying a significant trend) strongly suggest a consistent downward trajectory for the Rial. This trend is further underscored by the political fallout mentioned, where "in March, when the rate was 930,000 Rials to the Dollar, Iran’s parliament impeached his finance minister, Abdolnasser Hemmati over the crashing Rial and accusations of mismanagement." This single data point from March, indicating a rate far higher than the current official rate, vividly illustrates the extent of the Rial's decline. The dynamics of the exchange rate change are not just theoretical; they have real-world consequences. Observing "the dynamics of the exchange rate change for a week, for a month, for a year on the chart and in the tables" shows periods of rapid depreciation, often linked to new sanctions, political tensions, or domestic economic mismanagement. The Rial's value has been consistently eroded, making imports more expensive and diminishing the purchasing power of Iranian citizens. This long-term trend of a weakening Iranian Rial against the US Dollar is a central feature of Iran's economic narrative, reflecting deep-seated structural issues and external pressures that have continuously challenged its stability.Why Does the USD Iranian Rial Rate Fluctuate So Much?

The pronounced fluctuations in the USD Iranian Rial exchange rate are not random; they are the direct result of a complex interplay of geopolitical, economic, and internal factors. Unlike currencies in more stable economies, the Iranian Rial is highly sensitive to external pressures and internal policy decisions, leading to significant and often unpredictable shifts. The fundamental reason behind its volatility lies in the limited access to foreign currency within Iran, largely due to international sanctions, and the government's attempts to control the flow of the US Dollar. When demand for the US Dollar outstrips its limited supply in the open market, the Rial naturally depreciates. This demand is driven by various needs: individuals seeking to preserve their savings against inflation, businesses needing to import goods, and a general lack of confidence in the domestic currency. Furthermore, political events, both domestic and international, can trigger immediate reactions in the exchange rate. News of new sanctions, changes in oil prices (Iran's primary export), or shifts in diplomatic relations can cause the Rial to tumble or, occasionally, to strengthen slightly. The government's interventions, often through the Central Bank, to inject dollars into the market or implement new currency policies, also play a significant role, though their effectiveness is often debated. This constant push and pull creates an environment where the USD Iranian Rial rate is perpetually in flux, making it one of the most challenging currencies to predict globally.Economic Pressures and Sanctions

At the heart of the Iranian Rial's fragility are the extensive economic pressures and international sanctions imposed on Iran, primarily by the United States. These sanctions severely restrict Iran's access to the global financial system, limit its oil exports (a crucial source of foreign currency), and deter foreign investment. This isolation directly impacts the supply of US Dollars and other hard currencies within Iran, driving up their value in the open market. When Iran earns less foreign currency from oil sales, there are fewer dollars available to meet domestic demand, inevitably pushing the USD Iranian Rial rate higher. Moreover, the sanctions make it incredibly difficult for Iranian businesses to conduct international trade, forcing them to rely on informal channels or pay significant premiums for foreign exchange. This adds to the cost of imports and contributes to domestic inflation, further eroding the purchasing power of the Rial. The constant threat of new or intensified sanctions also creates an atmosphere of uncertainty, prompting individuals and businesses to convert their Rials into more stable assets like the US Dollar or gold, thereby increasing demand for hard currency and putting further downward pressure on the Rial. The impact of these sanctions is pervasive, affecting everything from daily consumer prices to large-scale economic planning, making them the single most significant factor in the depreciation of the Iranian Rial.Political Ramifications of a Falling Rial

The relentless depreciation of the Iranian Rial carries significant political ramifications within Iran, directly impacting the stability and public perception of the government. A falling Rial translates into higher inflation, as imported goods become more expensive, and the cost of living rises for ordinary citizens. This economic hardship often leads to public discontent and protests, putting immense pressure on political leaders. The provided data explicitly highlights this: "The falling Rial has put more pressure as well on Iranian reformist president Masoud Pezeshkian." This indicates that the currency's performance is a direct measure of the government's economic stewardship in the eyes of the populace. A vivid example of these political consequences is seen in the impeachment of a finance minister. "In March, when the rate was 930,000 Rials to the Dollar, Iran’s parliament impeached his finance minister, Abdolnasser Hemmati over the crashing Rial and accusations of mismanagement." This incident underscores how deeply intertwined the currency's value is with political accountability. When the Rial crashes, it's not just an economic event; it's a political crisis. Such events can destabilize governments, lead to cabinet reshuffles, and even spark broader social unrest. The government is constantly battling to stabilize the USD Iranian Rial rate, not just for economic reasons, but to maintain social order and political legitimacy. The struggle to manage the currency's value is, therefore, a central challenge for any Iranian administration.The Strength Factor: USD vs. Iranian Rial

When comparing the strength of the US Dollar versus the Iranian Rial, the answer is unequivocally clear: "The US Dollar is currently stronger than the Iranian Rial." This assertion is directly supported by the exchange rate itself. As the data indicates, "1 USD is equal to 42,125 IRR" (referring to the official rate), and even more dramatically, in the open market, 1 USD can fetch 938,000 IRR. Conversely, "1 IRR is worth 0.00002374 USD" (based on the official rate). These figures plainly illustrate the vast difference in value. The strength of a currency is determined by its purchasing power and its stability in international markets. The US Dollar, as the world's primary reserve currency, benefits from the stability of the US economy, its vast liquidity, and its role in global trade and finance. The Iranian Rial, on the other hand, has been severely weakened by years of sanctions, high inflation, and a lack of foreign investment, which have significantly eroded its purchasing power both domestically and internationally. While the official rate might suggest a certain level of control, the open market rate paints a more realistic picture of the Rial's weakness. The question "which is stronger, the Iranian Rial or the US Dollar" is consistently answered in favor of the US Dollar, a reality that has profound implications for Iran's economy and its citizens' financial well-being. This disparity means that even small amounts of USD hold significant value in Rials, making the US Dollar a highly sought-after asset within Iran.Accessing Real-Time Data and Tools for USD IRR

In a volatile currency market like that of the USD Iranian Rial, access to real-time data and reliable conversion tools is paramount for anyone seeking accurate information. Fortunately, several platforms offer these essential resources. You can "find the current US Dollar Iranian Rial rate and access to our USD IRR converter, charts, historical data, news, and more" through various financial websites and currency exchange services. These platforms are designed to provide up-to-the-minute information, crucial for making timely decisions. For example, to "get the latest 1 US Dollar to Iranian Rial rate for free," you can utilize universal currency converters that update their rates frequently. These tools often display the "FX spot rate USDIRR=X," though values might be "delayed up to 15 minutes." Beyond simple conversion, the ability to "check the currency rates against all the world currencies here" allows for broader financial analysis. Crucially, these platforms also offer "live Iranian Rial (IRR) exchange rates and gold price in Iran's free market," providing a more realistic view of the currency's value for those operating outside official channels. The availability of "USD to IRR currency charts" is also invaluable, enabling users to "pair exchange rate history for up to 10 years" and analyze trends like "is the US Dollar up or down against the Iranian Rial" over various periods. For instance, you can see how "today, US Dollar has faced a price increase in the open market like yesterday," with specific figures like the "price of US Dollar, which reached 905,000 yesterday with an increase of 1000 Rials, today Thursday 19 June 2025 reached 938,000 with an increase of 33000 Rials (3.65cent)." Such detailed, real-time data is indispensable for understanding the immediate movements of the USD Iranian Rial.Navigating the Iranian Rial: Practical Considerations

Navigating the complexities of the Iranian Rial, especially in relation to the US Dollar, requires practical awareness, particularly given the dual exchange rate system and the impact of sanctions. For individuals planning to travel to Iran or engage in transactions, understanding the practical implications of the USD Iranian Rial rate is vital. Firstly, it's crucial to distinguish between the official rate (e.g., 42,125 IRR to 1 USD) and the significantly higher open market rate (e.g., 938,000 IRR to 1 USD). Most visitors and local transactions will occur at or near the open market rate, which means the purchasing power of your US Dollars will be far greater than if you were to use the official rate. Secondly, cash is king in Iran, especially US Dollars, due to the limited functionality of international credit and debit cards. Bringing physical US Dollars and exchanging them at reputable money changers in the open market will likely yield the best rates. It's also important to be aware of the currency's symbols and codes: "The code for the American Dollar is USD," with the symbol "$," while "the code for the Iranian Rial is IRR," with the symbol "﷼." The dollar is divided into 100 cents, whereas "the Rial is divided into 0," implying no practical sub-units are used in daily transactions. Given the rapid fluctuations, checking the "live Iranian Rial (IRR) exchange rates" immediately before any exchange is highly recommended. Understanding these practicalities can help individuals and businesses effectively manage their finances when dealing with the Iranian Rial in a challenging economic environment.The Future Outlook for the USD Iranian Rial

Predicting the future outlook for the USD Iranian Rial is inherently challenging, given the multitude of unpredictable factors that influence its value. However, based on historical trends and current geopolitical realities, several key elements will likely continue to shape its trajectory. The primary driver will remain the status of international sanctions and Iran's relations with global powers, particularly the United States. Any significant shift in these dynamics – such as a breakthrough in nuclear negotiations leading to sanctions relief, or conversely, an escalation of tensions and new sanctions – would have an immediate and profound impact on the Rial's value. Sanctions relief would likely lead to a strengthening of the Rial as foreign currency inflows increase, while heightened tensions would almost certainly cause further depreciation. Domestically, the Iranian government's economic policies, including its ability to control inflation, manage the budget deficit, and attract investment, will also play a crucial role. The pressure on leaders like President Masoud Pezeshkian to stabilize the currency is immense, as the "falling Rial" directly affects public sentiment and political stability. Furthermore, global oil prices will continue to be a significant factor, as oil exports are Iran's main source of foreign exchange. A sustained increase in oil prices could provide some much-needed relief to the Rial, while a decline would exacerbate its weakness. While the "US Dollar is currently stronger than the Iranian Rial," the future of the USD Iranian Rial pair hinges on a delicate balance of external pressures, internal economic management, and geopolitical developments. For 2025 and beyond, volatility is likely to remain a defining characteristic, making continuous monitoring of "USD to IRR currency charts" and news essential for anyone interested in this complex currency.Conclusion

The journey through the dynamics of the USD Iranian Rial reveals a currency pair deeply intertwined with geopolitical forces, economic pressures, and the daily lives of millions. From the stark contrast between the official and open market rates to the profound impact of sanctions and political decisions, understanding the Iranian Rial's value against the US Dollar is far from a simple conversion exercise. We've explored how "the US Dollar is currently stronger than the Iranian Rial," the historical trends that show significant depreciation, and the critical factors that drive its constant fluctuations. Access to real-time data and reliable conversion tools is crucial for navigating this complex landscape, allowing individuals to "find the current US Dollar Iranian Rial rate" and track its movements. As we look ahead, the future of the USD Iranian Rial remains subject to the ebb and flow of international relations and domestic economic policies. For anyone interested in global economics, international trade, or simply the financial well-being of Iran, the USD Iranian Rial continues to be a compelling and important indicator. We hope this comprehensive guide has provided valuable insights into the intricate world of the USD Iranian Rial. What are your thoughts on the future of the Iranian Rial? Share your comments below, and if you found this article informative, please consider sharing it with others who might benefit from understanding this critical currency pair. Explore more articles on our site for deeper dives into global financial markets and currency dynamics.- Is Angelina Jolie Dead Get The Facts And Rumors Debunked

- Uproar Of Scandal In The Year Of 2024 A Deeper Exploration

- Discover The Ultimate Kannada Movie Paradise At Movierulzla

- Tylas Boyfriend 2024 The Ultimate Timeline And Analysis

- Kevin Jrs Wife Uncovering The Identity Behind The Mystery

With Inflation Ravaging Currency, Iran Is Changing Names and Numbers

Iran's presidential election: Four claims fact-checked - BBC News

Iran’s rial at all-time low over strong dollar, other woes