USD Vs Iranian Rial: Navigating Iran's Complex Currency

The relationship between the USD vs Iranian Rial is one of the most intriguing and often misunderstood aspects of global finance. Far from a simple exchange rate, it represents a complex interplay of economic policy, geopolitical forces, and the daily realities faced by millions. For anyone looking to understand Iran's economy or engage with its financial landscape, grasping the nuances of its currency is absolutely essential.

Unlike many other currencies, the Iranian Rial operates within a unique dual exchange rate system, where official government-set rates coexist with a more volatile open market. This duality creates a dynamic environment that demands careful attention and a deep dive into the underlying factors influencing the value of the Iranian Rial against the mighty US Dollar.

Table of Contents

- Understanding the Iranian Rial: More Than Just a Number

- The Dual Exchange Rate Dilemma: Official vs. Open Market

- Why the US Dollar Reigns Supreme Against the Rial

- Navigating Exchange Rate Data and Tools

- The Economic Implications of a Volatile Rial

- Key Factors Influencing the USD vs. Iranian Rial Exchange Rate

- The Future Outlook: What Lies Ahead for the Rial?

Understanding the Iranian Rial: More Than Just a Number

Before diving into the complexities of the USD vs Iranian Rial, it's crucial to understand the very fabric of Iran's currency. The official currency of Iran is indeed the Rial (IRR). However, a unique aspect of daily life in Iran is that people commonly express the prices of goods and services in "Tomans." One Toman is equivalent to 10 Rials. So, if you hear something costs "100 Tomans," it actually means 1,000 Rials. This dual nomenclature can be confusing for outsiders but is second nature to Iranians, a historical quirk that persists despite various attempts at currency reform.

- Ll Cool Js Luxurious Mansion A Haven For Hiphop Royalty

- Leland Melvin The Astronaut And Engineer Extraordinaire

- Katiana Kay Full Video Uncensored And Explicit

- Exclusive Leaked Content Unveiling The Power Behind The Midget On Onlyfans

- The Unveiling Of Rebecca Vikernes Controversial Figure Unmasked

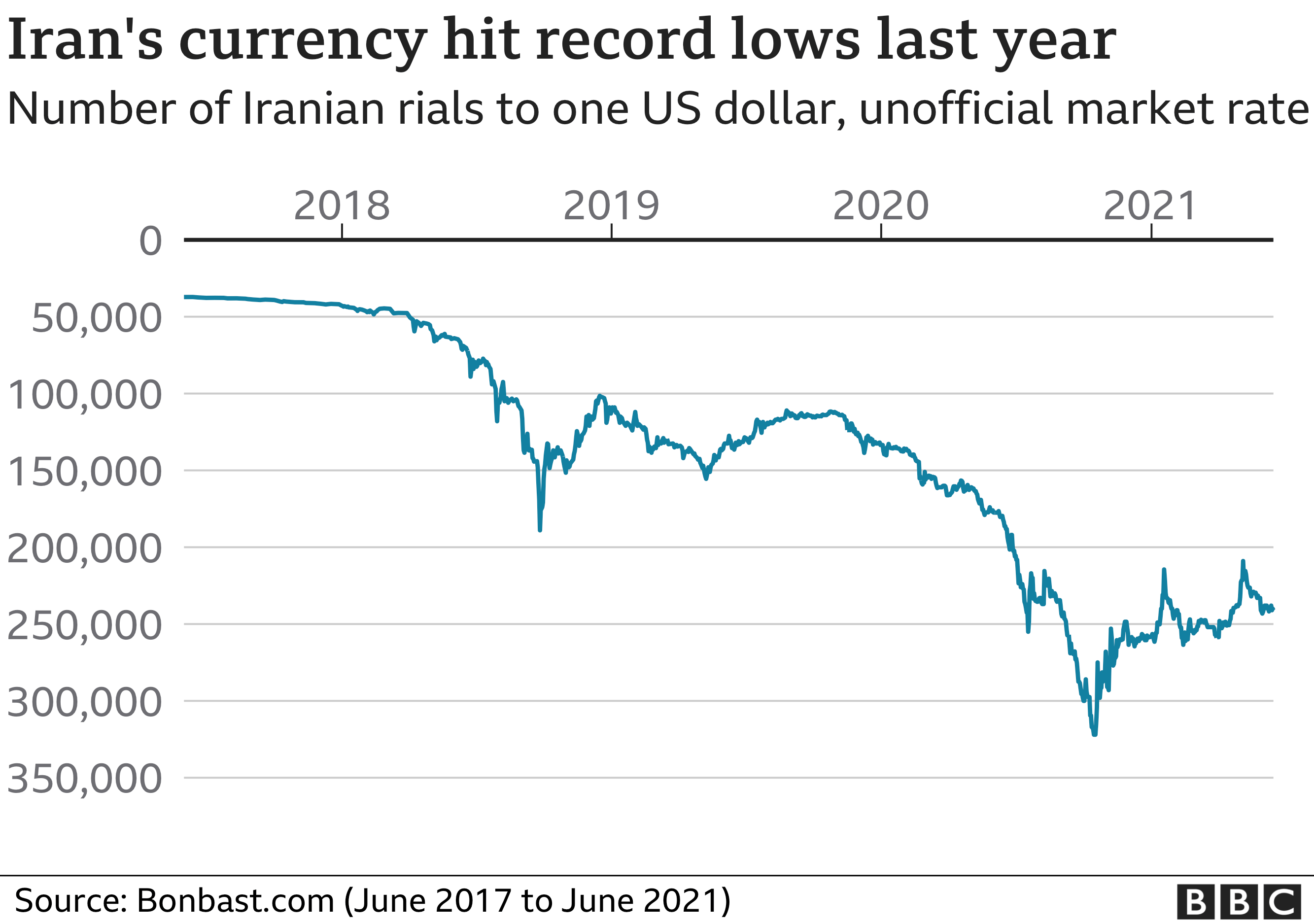

The history of the Iranian Rial has been marked by periods of significant volatility and depreciation, largely driven by internal economic policies and external pressures, particularly international sanctions. This has led to a persistent challenge in maintaining the currency's stability and purchasing power, making the exchange rate against major foreign currencies like the US Dollar a constant point of focus for both citizens and policymakers.

The Dual Exchange Rate Dilemma: Official vs. Open Market

One of the most distinctive features of Iran's financial landscape is its dual exchange rate system. This means there isn't just one exchange rate for the USD vs Iranian Rial; rather, there are two significantly different rates operating simultaneously: the official rate set by the government and the open (or black) market rate. This system is a direct consequence of Iran's economic structure, heavily influenced by oil revenues, government subsidies, and, most notably, international sanctions.

The rationale behind this duality often stems from the government's desire to control the flow of foreign currency, prioritize essential imports, and stabilize prices for basic goods. For instance, in 2012, the Iranian government launched a foreign exchange center specifically designed to provide importers of certain basic goods with foreign exchange at a rate approximately 2% cheaper than the prevailing open market rate on any given day. This intervention aims to shield the public from the full impact of market fluctuations on critical necessities.

- The Incredible Lou Ferrigno Jr Rise Of A Fitness Icon

- Shag Carpet Installation Your Ultimate Guide To Easy Home Upgrades

- Taylor Swifts Enchanting Feet A Tale Of Grace And Enthrallment

- The Ultimate Guide To Accessing Netflix For Free Unlock Hidden Accounts

- Stefania Ferrario An Inspiring Entrepreneur

The Official Exchange Rate: A Glimpse into Stability (on paper)

The official exchange rate is the rate at which the Iranian government and its affiliated entities conduct their foreign currency transactions. This rate is typically much stronger for the Rial compared to the open market rate and is often used for official trade, government expenditures, and certain subsidized imports. According to recent data, as of June 20, 2025, the official exchange rate for 1 US Dollar is approximately 42,125 Iranian Rials. Other data points confirm this range, showing 1 USD = 42,232.319464 IRR on June 20, 2025, and 1 USD = 42,100 IRR on June 16, 2025.

What's striking about the official rate is its apparent stability. Data indicates that over the past week, the value of the US Dollar has remained relatively stable against this official rate, with a 0.000% decrease compared to its value seven days ago. Similarly, the performance of the USD to IRR in the last 30 days and 90 days saw a high and low of 42,000.0000, with a 30-day average also at 42,000.0000, and a change of 0.00. This consistency suggests a managed or fixed rate, designed to provide a predictable environment for government-controlled transactions.

The Open Market Rate: Reflecting Economic Realities

In stark contrast to the official rate is the open market rate, also commonly referred to as the black market rate. This is the rate at which ordinary Iranians and businesses conduct their day-to-day foreign currency exchanges, reflecting the true supply and demand dynamics, as well as public sentiment regarding the economy. This rate is significantly weaker for the Rial and is far more volatile. For instance, while the official rate hovers around 42,000 IRR to 1 USD, recent data from June 19, 2025, shows the US Dollar in the open market reaching 938,000 Rials, an increase of 33,000 Rials (3.65%) from the previous day's 905,000 Rials. The highest price of the US Dollar in the last 24 hours was 938,000 Rials, which was also its lowest price, indicating a sudden jump.

This massive disparity between the official and open market rates is a clear indicator of the economic pressures facing Iran. The open market rate is highly sensitive to factors such as inflation, the impact of international sanctions, political developments, and the public's demand for foreign currency as a hedge against the Rial's depreciation. It is this rate that truly dictates the purchasing power of the average Iranian and the cost of imported goods for most businesses.

Why the US Dollar Reigns Supreme Against the Rial

It is unequivocally clear that the US Dollar is currently much stronger than the Iranian Rial. As the data shows, 1 USD is equal to approximately 42,125 IRR (official rate) or even 938,000 IRR (open market rate), while conversely, 1 IRR is worth a mere 0.00002374 USD. This significant imbalance is not accidental; it is the culmination of several decades of economic challenges and geopolitical isolation that have profoundly impacted the Iranian economy and its currency.

Key factors contributing to the Rial's weakness include:

- International Sanctions: Decades of comprehensive sanctions, particularly those imposed by the United States, have severely limited Iran's access to global financial systems, restricted its oil exports, and deterred foreign investment. This has choked off foreign currency inflows, putting immense pressure on the Rial.

- High Inflation: Iran has grappled with persistently high inflation rates, eroding the purchasing power of the Rial and encouraging citizens to convert their savings into more stable assets like foreign currencies or gold.

- Government Policies and Deficits: While the government attempts to manage the economy, large budget deficits and certain economic policies can contribute to money supply growth, further fueling inflation and weakening the currency.

- Limited Diversification: Despite efforts, the Iranian economy remains heavily reliant on oil exports. Fluctuations in global oil prices directly impact the country's foreign currency reserves and, consequently, the Rial's value.

- Lack of Trust: Public confidence in the Rial has been eroded over time due to its continuous depreciation, leading to a flight to foreign currency as a store of value.

Navigating Exchange Rate Data and Tools

For anyone interested in the USD vs Iranian Rial, whether for academic purposes, business, or personal understanding, accessing accurate and up-to-date exchange rate information is paramount. Given the dual nature of the currency, it's crucial to know which rate you are looking at and where to find reliable data. Comprehensive information about the USD/IRR, including historical data, charts, and converters, is available through various online platforms.

Many financial websites offer free currency converters, allowing you to convert United States Dollars to Iranian Rials from any amount. Tools like the original universal currency converter or the Markets Insider currency calculator provide a straightforward way to see the current rates. However, for Iran, it's vital to ensure the tool specifies whether it's providing the official or, more importantly, the live Iranian Rial (IRR) exchange rates from Iran's free market or black market, as these are the rates that reflect real-world transactions for most people.

Real-Time Conversion: Your Gateway to Current Rates

In a volatile market like Iran's open currency exchange, real-time data is invaluable. Our real-time US Dollar Iranian Rial converter, and similar tools, enable you to convert your amount from USD to IRR with all prices in real-time. This is particularly important because, as we saw with the recent 3.65% increase in the open market rate for the US Dollar on June 19, 2025, prices can shift significantly within a single day. Checking the currency rates against all world currencies, specifically focusing on live Iranian Rial (IRR) exchange rates and gold prices in Iran's free market, provides the most accurate picture for practical purposes.

Historical Data and Charts: Predicting Future Fluctuations

Beyond current rates, understanding the historical performance of the US Dollar to Iranian Rial exchange rate is key to analyzing fluctuations and potentially predicting future trends. Many platforms offer detailed exchange rate history, allowing users to see how the rate has moved over weeks, months, or even years. An Iranian Rial exchange rate chart, often based on 30-day or longer periods, can visually represent these changes, highlighting periods of stability or rapid depreciation. This historical perspective is crucial for anyone trying to gauge the long-term trajectory of the Rial's value and the persistent strength of the US Dollar against it.

Accessing Iranian Rial in black market exchange rates for 28+ currencies and gold prices provides an even broader understanding of how the informal market operates and how individuals and businesses hedge against currency risks. These charts and historical data points are essential for informed decision-making in a market characterized by significant volatility and a stark difference between official and unofficial valuations.

The Economic Implications of a Volatile Rial

The persistent weakness and volatility of the Iranian Rial, particularly in the open market, have profound implications for Iran's economy and its citizens. For the average Iranian, a depreciating Rial means a continuous erosion of purchasing power. The cost of imported goods, from medicines to electronics, skyrockets, leading to higher inflation and a decrease in living standards. Savings held in Rials rapidly lose value, pushing many to seek refuge in foreign currencies like the US Dollar or physical assets like gold, which often trades at a premium in the free market.

For businesses, especially those reliant on imports, the fluctuating USD vs Iranian Rial rate creates immense uncertainty. Planning and budgeting become challenging, and the risk of unexpected cost increases is high. While the government's foreign exchange center aims to provide some relief for essential goods, many businesses operate on the open market, facing the full brunt of the Rial's instability. This environment can stifle investment, discourage long-term planning, and contribute to economic stagnation.

The dual exchange rate system itself, while intended to manage resources, can also lead to arbitrage opportunities and distortions in the economy, sometimes fostering corruption and inefficiencies. It creates a complex web where different sectors of the economy operate under vastly different currency valuations, leading to uneven playing fields and economic disparities.

Key Factors Influencing the USD vs. Iranian Rial Exchange Rate

Understanding the dynamic between the USD vs Iranian Rial requires a look at the multifaceted factors that exert pressure on the Rial's value. These influences are often interconnected and can lead to rapid shifts in the open market rate:

- Geopolitical Developments: News related to international relations, particularly with the United States and other Western powers, can have an immediate and significant impact. Tensions, negotiations, or new sanctions announcements often lead to a sharp depreciation of the Rial as market participants react to perceived risks.

- Oil Prices and Exports: As a major oil producer, Iran's foreign currency earnings are heavily dependent on oil sales. Fluctuations in global oil prices and, more critically, Iran's ability to export its oil (often hindered by sanctions) directly affect the supply of foreign currency in the economy, thereby influencing the Rial's strength.

- Domestic Economic Policies: Government decisions regarding monetary policy, fiscal spending, and subsidies can either stabilize or destabilize the Rial. Large budget deficits, for instance, can lead to increased money supply and inflation, pushing the Rial down.

- Inflation Rates: High domestic inflation erodes the purchasing power of the Rial. When goods and services become more expensive locally, people tend to seek out more stable foreign currencies to preserve their wealth, increasing demand for the US Dollar.

- Public Confidence and Speculation: In an environment of uncertainty, public sentiment plays a huge role. Fear of further depreciation can lead to speculative buying of foreign currency, creating a self-fulfilling prophecy of a weaker Rial. Conversely, positive news, however rare, can briefly boost confidence.

- Regional Stability: Events in the broader Middle East can also affect investor confidence and economic stability in Iran, indirectly impacting the currency.

The Future Outlook: What Lies Ahead for the Rial?

Predicting the future of the Iranian Rial is inherently challenging, given the complex interplay of internal and external factors. The fundamental dynamic of the USD vs Iranian Rial relationship is likely to remain characterized by the significant disparity between official and open market rates, as long as the underlying economic and geopolitical conditions persist.

Any significant strengthening of the Rial would likely require a combination of factors: a sustained lifting of international sanctions, leading to increased oil exports and foreign investment; robust and diversified economic growth that reduces reliance on oil; and sound domestic economic policies that tackle inflation and build public trust. Without such fundamental shifts, the open market rate for the Rial is expected to remain volatile and susceptible to depreciation, while the official rate will likely continue to serve its specific, controlled purpose.

For individuals and businesses, the emphasis will continue to be on monitoring real-time open market rates and understanding the factors that drive them. The Rial's journey reflects not just economic numbers, but the resilience and challenges faced by a nation navigating a unique and often turbulent financial landscape.

Conclusion

The intricate dance between the US Dollar and the Iranian Rial is a microcosm of Iran's broader economic and geopolitical reality. It is a story of two currencies operating in parallel, one tightly controlled and the other reflecting the raw forces of supply, demand, and sentiment. While the official rate for the <

- The Allure Of Camilla Araujo Fapello A Starlets Rise To Fame

- The Unparalleled Expertise Of Norm Abram Your Home Improvement Guru

- The Tragic Accident That Took Danielle Grays Life

- Ryan Paeveys Wife Meet The Actors Life Partner

- Ultimate Guide To Kpopdeepfake Explore The World Of Aigenerated Kpop Content

With Inflation Ravaging Currency, Iran Is Changing Names and Numbers

USMNT predicted XI vs. Iran: Why Jesús Ferreira may get the nod at

Iran's presidential election: Four claims fact-checked - BBC News